All Categories

Featured

Table of Contents

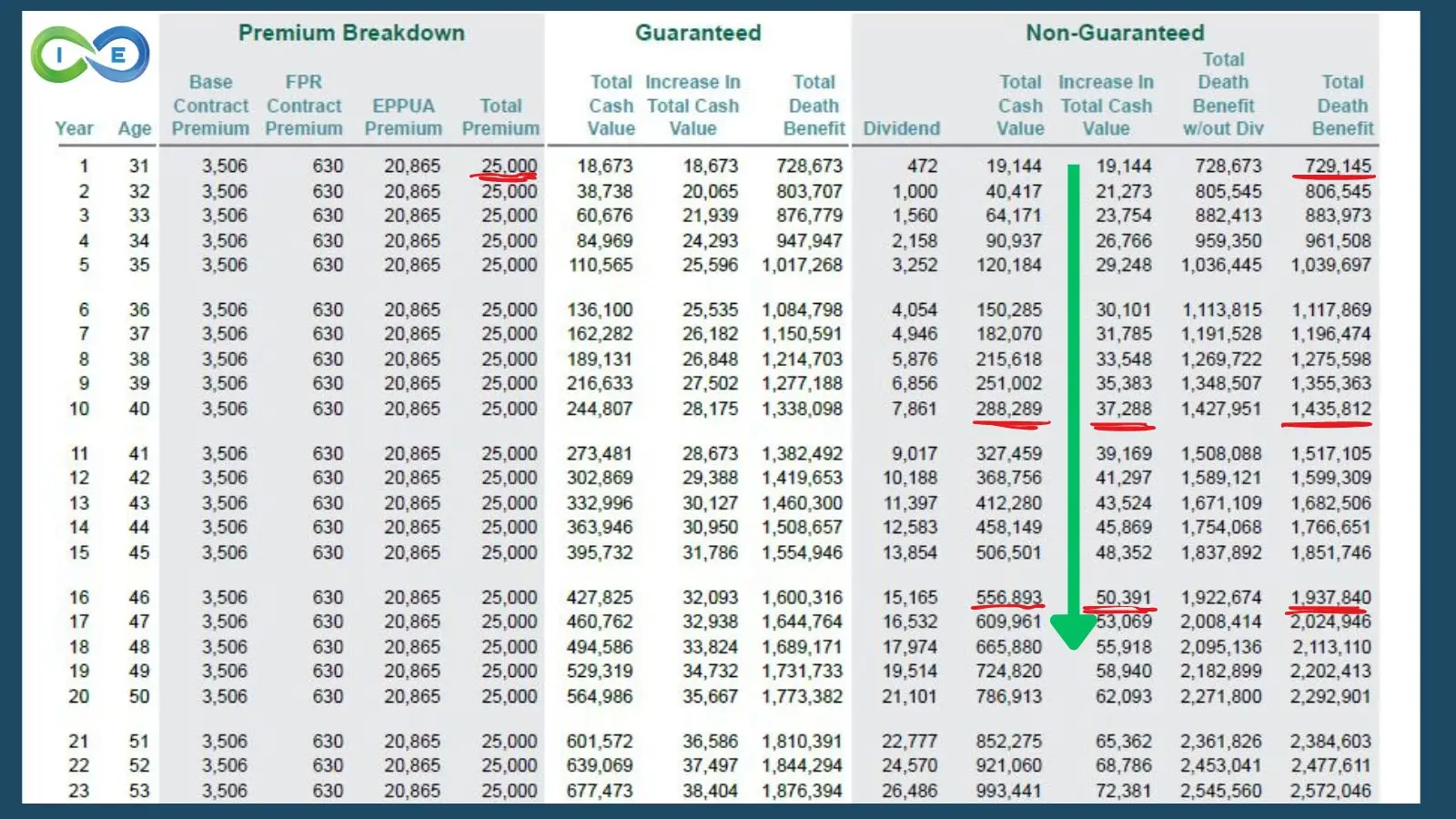

Using the above example, when you take out that exact same $5,000 financing, you'll make returns on the whole $100,000. It's still fully moneyed in the eyes of the mutual life insurance policy firm. For unlimited banking, non-direct acknowledgment policy financings are perfect. Last but not least, it's essential that your plan is a blended, over-funded, and high-cash worth plan.

Motorcyclists are extra attributes and benefits that can be included in your policy for your particular demands. They allow the insurance holder acquisition a lot more insurance policy or change the conditions of future purchases. One reason you might desire to do this is to get ready for unexpected wellness troubles as you age.

If you include an added $10,000 or $20,000 upfront, you'll have that cash to the financial institution from the start. These are just some actions to take and take into consideration when setting up your way of life banking system. There are several various methods which you can take advantage of way of living financial, and we can aid you locate te best for you.

Alliance Bank Visa Infinite

When it pertains to economic planning, entire life insurance policy usually stands out as a popular option. There's been an expanding fad of advertising and marketing it as a tool for "unlimited banking (infinite banking wiki)." If you've been discovering entire life insurance policy or have stumbled upon this concept, you could have been informed that it can be a way to "become your very own bank." While the concept might appear appealing, it's crucial to dig much deeper to comprehend what this truly means and why checking out entire life insurance policy this way can be misleading.

The idea of "being your very own financial institution" is appealing because it recommends a high level of control over your financial resources. This control can be illusory. Insurer have the best say in how your policy is handled, including the regards to the loans and the prices of return on your money worth.

If you're considering entire life insurance policy, it's essential to see it in a broader context. Entire life insurance coverage can be an important device for estate preparation, offering an assured death advantage to your beneficiaries and potentially using tax advantages. It can also be a forced savings car for those who have a hard time to conserve cash continually.

It's a type of insurance with a savings element. While it can use constant, low-risk development of cash value, the returns are normally reduced than what you could attain with other financial investment lorries. Before delving into whole life insurance policy with the concept of boundless banking in mind, take the time to consider your financial goals, risk resistance, and the full series of financial products offered to you.

Limitless financial is not a financial cure all. While it can operate in specific situations, it's not without threats, and it calls for a substantial dedication and recognizing to handle effectively. By identifying the potential risks and comprehending truth nature of whole life insurance policy, you'll be much better geared up to make an informed choice that sustains your economic well-being.

As opposed to paying financial institutions for things we need, like autos, houses, and school, we can buy means to maintain more of our cash for ourselves. Infinite Banking method takes an innovative strategy toward individual finance. The approach basically includes becoming your own financial institution by making use of a dividend-paying whole life insurance policy policy as your financial institution.

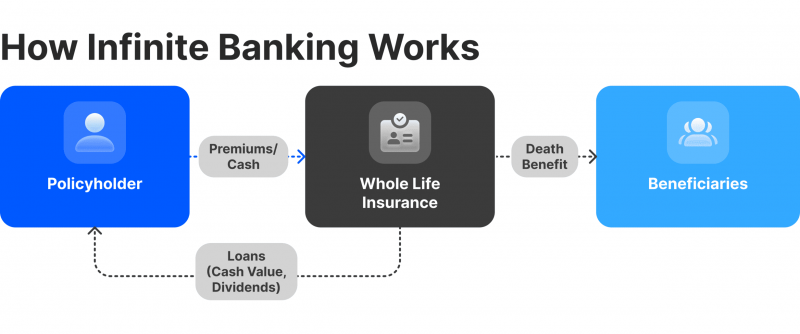

How Infinite Banking Works

It provides significant development gradually, transforming the conventional life insurance policy plan into a strong financial tool. While life insurance firms and banks run the risk of with the fluctuation of the marketplace, the negates these dangers. Leveraging a cash value life insurance coverage policy, people appreciate the benefits of ensured growth and a survivor benefit protected from market volatility.

The Infinite Banking Concept shows just how much wealth is completely moved away from your Family members or Business. Nelson additionally takes place to clarify that "you finance whatever you buyyou either pay rate of interest to somebody else or quit the interest you could have otherwise made". The genuine power of The Infinite Banking Concept is that it solves for this problem and equips the Canadians who welcome this concept to take the control back over their financing requires, and to have that money moving back to them versus away.

This is called shed chance cost. When you pay cash money for things, you completely quit the chance to make interest by yourself cost savings over multiple generations. To fix this issue, Nelson created his own banking system via making use of dividend paying getting involved entire life insurance policies, ideally through a shared life company.

As a result, insurance holders have to very carefully examine their economic objectives and timelines prior to deciding for this method. Sign up for our Infinite Financial Training Course.

Infinite Banking Scam

Remember, The unlimited Financial Principle is a procedure and it can substantially boost whatever that you are already carrying out in your existing monetary life. Exactly how to get nonstop intensifying on the routine payments you make to your cost savings, reserve, and retirement accounts Exactly how to position your hard-earned money to make sure that you will certainly never ever have one more sleepless evening fretted regarding how the marketplaces are mosting likely to react to the next unfiltered Governmental TWEET or international pandemic that your family members merely can not recuperate from How to pay yourself initially using the core principles shown by Nelson Nash and win at the cash game in your own life How you can from third celebration financial institutions and lending institutions and move it right into your very own system under your control A structured method to make certain you pass on your riches the method you want on a tax-free basis How you can move your money from for life tired accounts and shift them into Never ever strained accounts: Hear exactly how people just like you can implement this system in their very own lives and the effect of putting it right into action! That developing your own "Infinite Banking System" or "Wealth System" is possibly the most impressive approach to shop and protect your cash money circulation in the country Exactly how implementing The Infinite Banking Refine can create a generation surge result and educate real stewardship of money for multiple generations Just how to be in the motorist's seat of your monetary destiny and ultimately develop that is safeguarded and just goes one directionUP! The duration for establishing and making significant gains with infinite financial mostly depends upon numerous elements distinctive to an individual's financial setting and the policies of the economic institution catering the service.

Additionally, a yearly dividend repayment is another substantial advantage of Unlimited financial, more stressing its appearance to those tailored towards lasting financial growth. However, this method needs mindful consideration of life insurance expenses and the interpretation of life insurance policy quotes. It's critical to analyze your credit scores record and confront any kind of existing bank card debt to guarantee that you are in a desirable placement to embrace the approach.

A crucial aspect of this method is that there is ignorance to market changes, due to the nature of the non-direct acknowledgment car loans used. Unlike financial investments connected to the volatility of the markets, the returns in unlimited financial are steady and foreseeable. However, additional money over the costs repayments can also be included in quicken growth.

Infinite Bank

Insurance policy holders make regular premium repayments into their participating entire life insurance policy plan to maintain it effective and to construct the policy's total money value. These superior repayments are usually structured to be regular and foreseeable, guaranteeing that the plan continues to be energetic and the cash money worth continues to grow gradually.

The life insurance coverage policy is designed to cover the entire life of a specific, and not simply to aid their beneficiaries when the private dies. That stated, the policy is participating, implying the policy proprietor becomes a component proprietor of the life insurance coverage company, and takes part in the divisible earnings produced in the kind of dividends.

"Below comes Income Canada". That is not the case. When returns are chunked back into the plan to purchase paid up additions for no additional expense, there is no taxable occasion. And each paid up enhancement likewise gets returns each and every single year they're declared. Now you may have listened to that "dividends are not guaranteed".

Table of Contents

Latest Posts

Infinite Banking Spreadsheets

Infinite Banking Examples

Can I Be My Own Bank

More

Latest Posts

Infinite Banking Spreadsheets

Infinite Banking Examples

Can I Be My Own Bank